Existing Asset

Disposition

Lakeland investment strategies focus on multifamily real estate in supply-constrained markets, with high growth driven by affordability, quality of life, and strong employment drivers.

Beyond this, of all the characteristics that one might attribute to success, we are equally conscientious in our efforts to act with integrity. Integrity matters and everything flows from this essential trait – analysis, objectivity, responsibility, quality, service to renters and investors both – it is the mantra that guides Lakeland Capital – and is the foundation of a successful portfolio.

Selected Investments

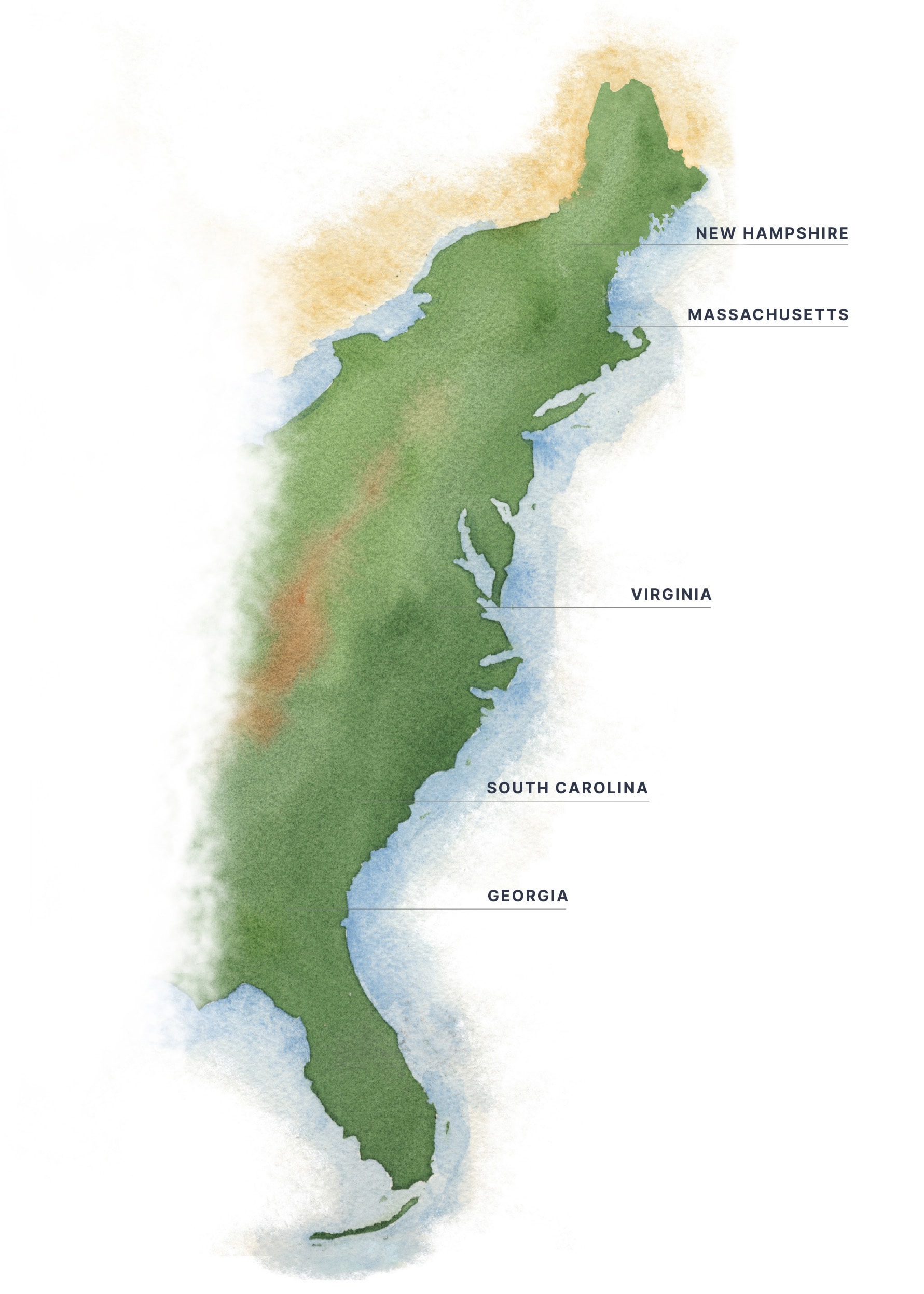

All

Georgia

South Carolina

Virginia

Massachusetts

New Hampshire

- Georgia

- Acquired 2025

Oaks at Victory

- South Carolina

- Acquired 2024

The Reserve at River Walk

- Georgia

- Acquired 2024

Savan Pointe

- Virginia

- Acquired 2024

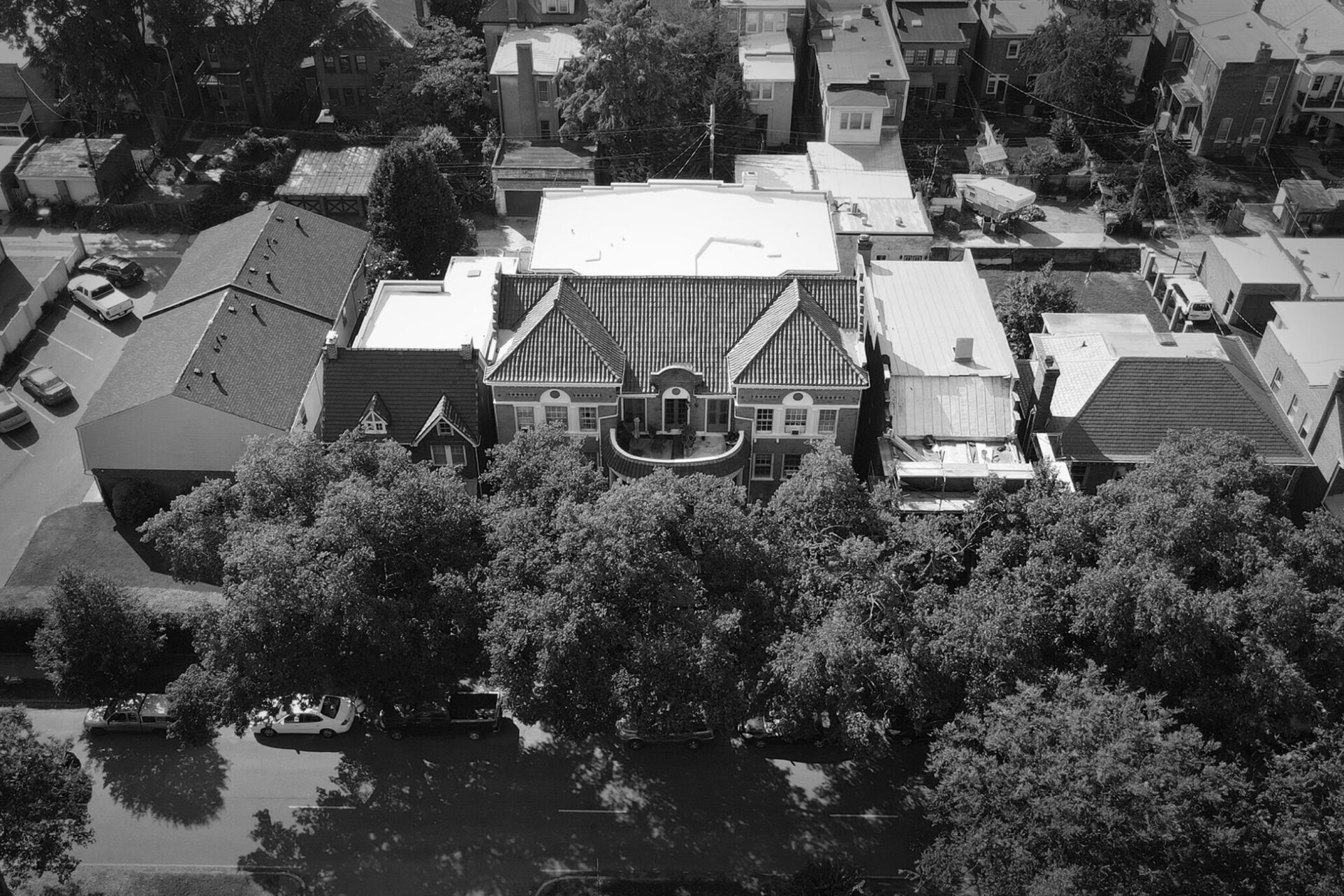

The Parkwood

- Massachusetts

- Acquired 2024

135 Main Street

- Georgia

- Acquired 2023

The Retreat at Savannah

- South Carolina

- Acquired 2023

Summerville Portfolio

- South Carolina

- Acquired 2023

King Street Portfolio

- New Hampshire

- Acquired 2023

Elaine Street Portfolio

- Virginia

- Acquired 2023

Riverside Drive Apartments

- Virginia

- Acquired 2022

1140 West Grace Street

- Virginia

- Acquired 2022

South Arthur Ashe Boulevard Portfolio

- Massachusetts

- Acquired 2022

36 Crescent Street

- Virginia

- Acquired 2021

South Cape Henry Apartments

- Massachusetts

- Disposition 2021

12 Chandler Avenue

- Massachusetts

- Acquired 2020