When it comes to analyzing geographical markets, we believe there is much more to the story than just top-line indicators. Looking deeper, each submarket has its own unique investment profile that deserves careful examination.

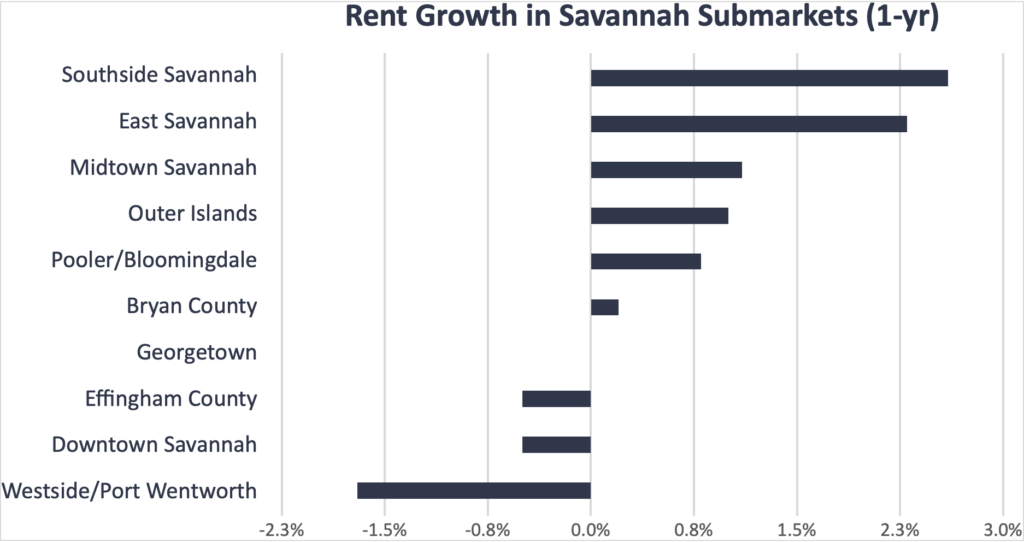

In Savannah, rent growth is up 0.5% this year, driven by increases in six of the ten submarkets across the metro area. Leading the pack has been Southside Savannah at 2.6% and East Savannah at 2.3%.

What drives each submarket can vary greatly. A lack of new supply in Southside Savannah has led to the lowest vacancy rate in the region at just 5.7%. In East Savannah’s case, construction has increased in certain neighborhoods, while historic, centrally located ones, like East Victory Drive Corridor, have not seen any significant new supply in nearly a half-century, resulting in net absorption rates projected to outpace the metro average over the next four years.

These are just some of the trends that we believe are imperative for investors to consider when adding exposure to the Savannah market.